Projects

At Falcon this is what we do.

The Lola Graphite Project

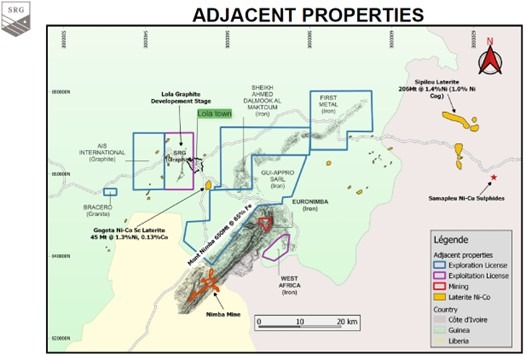

The Lola Graphite Project is located approximately 1,000 kilometers South-East of Conakry, the capital of the Republic of Guinea. The Lola Graphite Project was named after the nearby town of Lola, located approximately 3.5 kilometers to the east of the deposit.

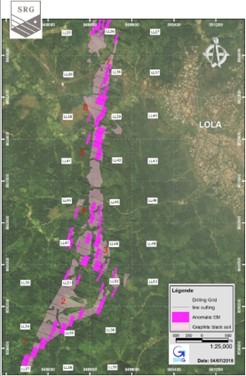

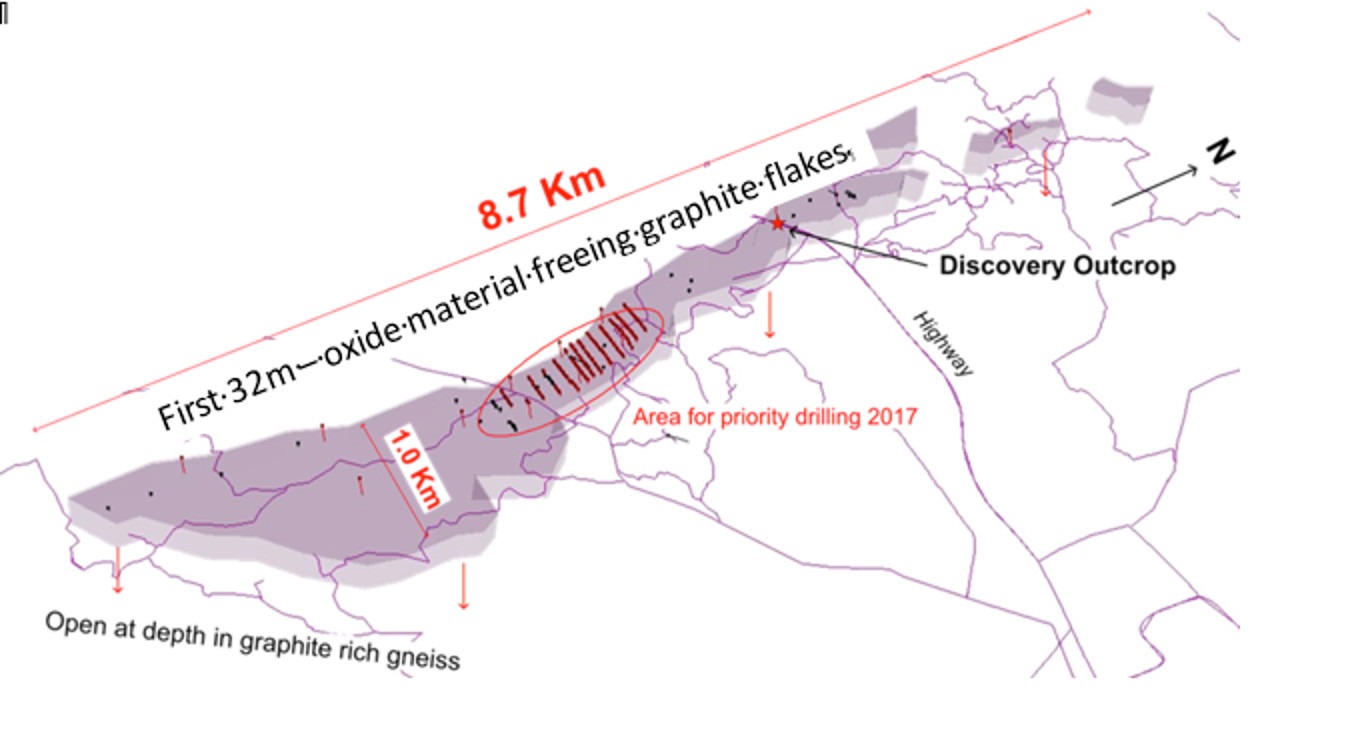

The Lola Graphite Project deposit is present at surface over 8.7 kilometers strike length and is an average of 370 meters wide. The first 20 to 50 meters depth (average of 32 meters) of the deposit is weatheredlaterite, free-digging, graphite flakes which allows for easy grinding and optimal recovery of all flakes sizes. Over 50% of the graphite is large flake (+80mesh), and 26% is “jumbo” flake material (+50 mesh ).

%

Owned

Strick Length

Wide

%

*Jumbo* Flake (+50 mesh)

%

*Jumbo* Flake (+50 mesh)

The graphite mineralization continues at depth within the non-weathered sheared gneiss. In 2017 Falcon Energy Materials completed a drilling program of 7,057m and drilling continued through into 2018. As of March 21st, 2018, 346 diamond drill holes for a total of Between 2013 and 2018 a total of 22,590 m of core had been drilled in 648 holes and 16,059 samples are the basis for the resources estimations.

The Lola Graphite occurrence was originally discovered by BUMIFOM (“Bureau Minier de la France Outremer”) during construction of the Conakry-Lola road in 1951. Shortly after Guinea’s declaration of independence in 1958, the project was abandoned until Falcon Energy Materials “re-discovered” the deposit in 2012.

Resource Estimate (1.65% Cg Cut-Off)

| Category | Tonnes (Mt) | Grade (%Cg) | Contained (kt) | |

|---|---|---|---|---|

| Saprolite | Measured | 6.84 | 4.39 | 300.3 |

| Indicated | 23.24 | 4.04 | 937.9 | |

| Inferred | 1.20 | 3.81 | 45.6 | |

| Hard Rock | Indicated | 15.96 | 4.03 | 643.4 |

| Inferred | 3.05 | 3.73 | 113.8 | |

| Total | Meas. & Ind. | 46.03 | 4.09 | 1,881.6 |

| Inferred | 4.25 | 3.75 | 159.4 |

1. Pit shell defined using 30-degree pit slope, $1,400/t of concentrate (96% Cg grade, 75% Cg plant recovery), $1.80/t mining cost, $8.00/t processing cost, $3.50/t G&A and $100/t of concentrate transport costs

2. Mineral resources are not mineral reserves and have no demonstrated economic viability. The estimate of mineral resources may be materially affected by mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors

3. Effective Date of Resource Estimate is June 18, 2019.

4. Please refer to the technical report filed on SEDAR for full details.

Mineral Reserves at 1.7% Cut-off

| Resources | M Tonnes | Volume (Mm3) | Grade (%Cg) |

|---|---|---|---|

| Proved - Oxide | 6.67 | 4.13 | 4.43% |

| Probable - Oxide | 20.89 | 12.92 | 4.11% |

| Probable - Fresh Rock | 14.50 | 7.56 | 4.15% |

| Total Proved and Probable Reserves | 42.06 | 24.61 | 4.17% |

* due to rounding, totals may not add-up exactly.

Strategic Update & Studies

Falcon Energy Materials aims to become a fully integrated supplier of battery anode material to the European market. The integrated business model would result in the creation of a mine-to-market active anode material producer, hosting a large high-purity graphite production mine and concentrator in Africa and a value-added, coated spherical purified graphite (“CSPG”) conversion facility in Europe or the United States of America.

The Company is preparing an updated feasibility study (the “Updated Feasibility Study” or “UFS”), which will include basic engineering, to confirm technical opportunities and capital and operating costs for target initial production of 100,000 tonnes per annum (“tpa”) of graphite concentrate from the Lola Graphite Project. The UFS follows the 2019 Feasibility Study which was prepared by DRA Global Limited (“DRA”).

Following extensive consultation with its partners, technical consultants, industry participants and potential offtake partners Falcon Energy Materials has concluded that an increase in concentrate production, from 50,000 tpa as disclosed in the 2019 Feasibility Study to 100,000 tpa, is expected to significantly increase capital efficiency and project economics. The Updated Feasibility Study will also be prepared by DRA and is scheduled to be completed in Q4 2022.

In parallel with the UFS the Company is also preparing an independent, preliminary economic assessment (“PEA”) of initial options for the start-up of a second transformation step to produce CSPG from the Lola Graphite Project graphite concentrate. The PEA will be prepared by Dorfner Analysenzentrum und Anlagenplanungsgesellschaft mbH (“Anzaplan”), a leading consultancy and engineering company for industrial, specialty mineral and metal projects, based in Hirschau, Germany. The PEA is scheduled to be completed in Q1 2023.

An integral part of the PEA will be to update existing metallurgical test work on spheroidization, purification and coating aspects to produce a high-quality CSPG product. The Company will provide Anzaplan and its partners with part of its 10 tonnes bulk sample concentrate, which it has available from previous pilot-scale metallurgical test work. The results of the additional metallurgical test work will also provide valuable samples for future offtakers to accelerate the extensive product qualification and test work required by cell manufacturers.